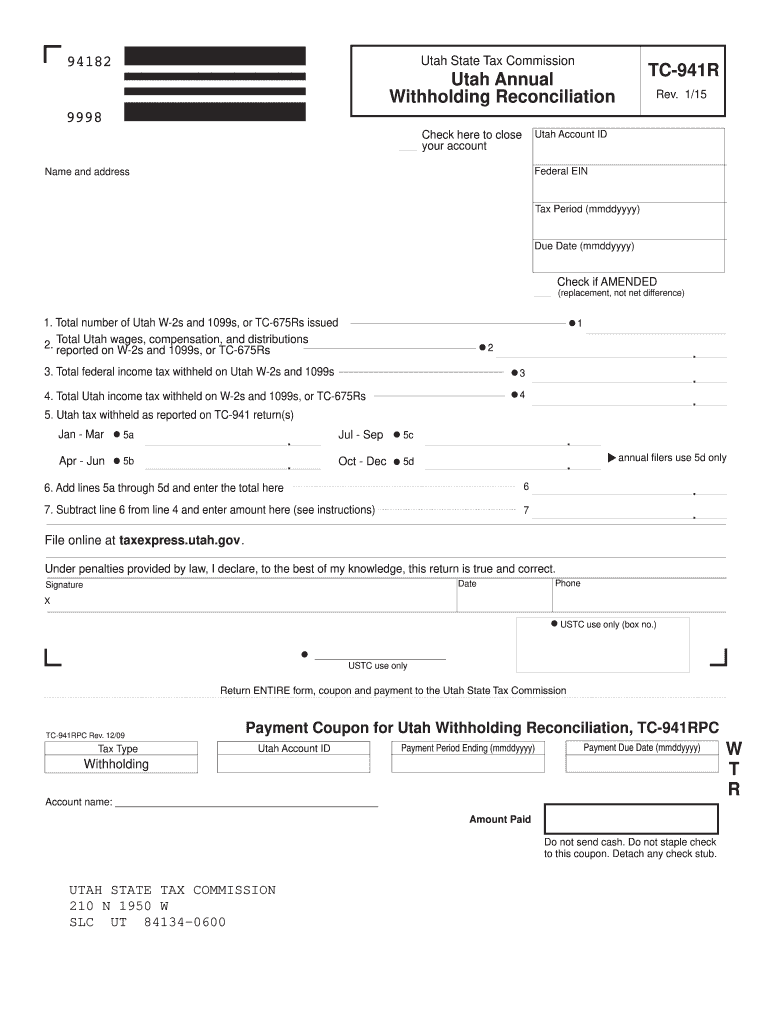

Utah State Withholding Form 2025. Employers should regularly consult with the utah department of workforce services or refer to their annual tax rate notice to stay updated on the annual rate. The new w4 asks for a dollar amount.

The utah state tax commission has updated publication 14, withholding tax guide to reflect a reduction in the income tax withholding rate from 4.85% to 4.65%. This means that whether you file taxes as an individual, a head of the household or with your spouse, you face the same.

Utah state withholding form Fill out & sign online DocHub, Calculate your state income tax step by step.

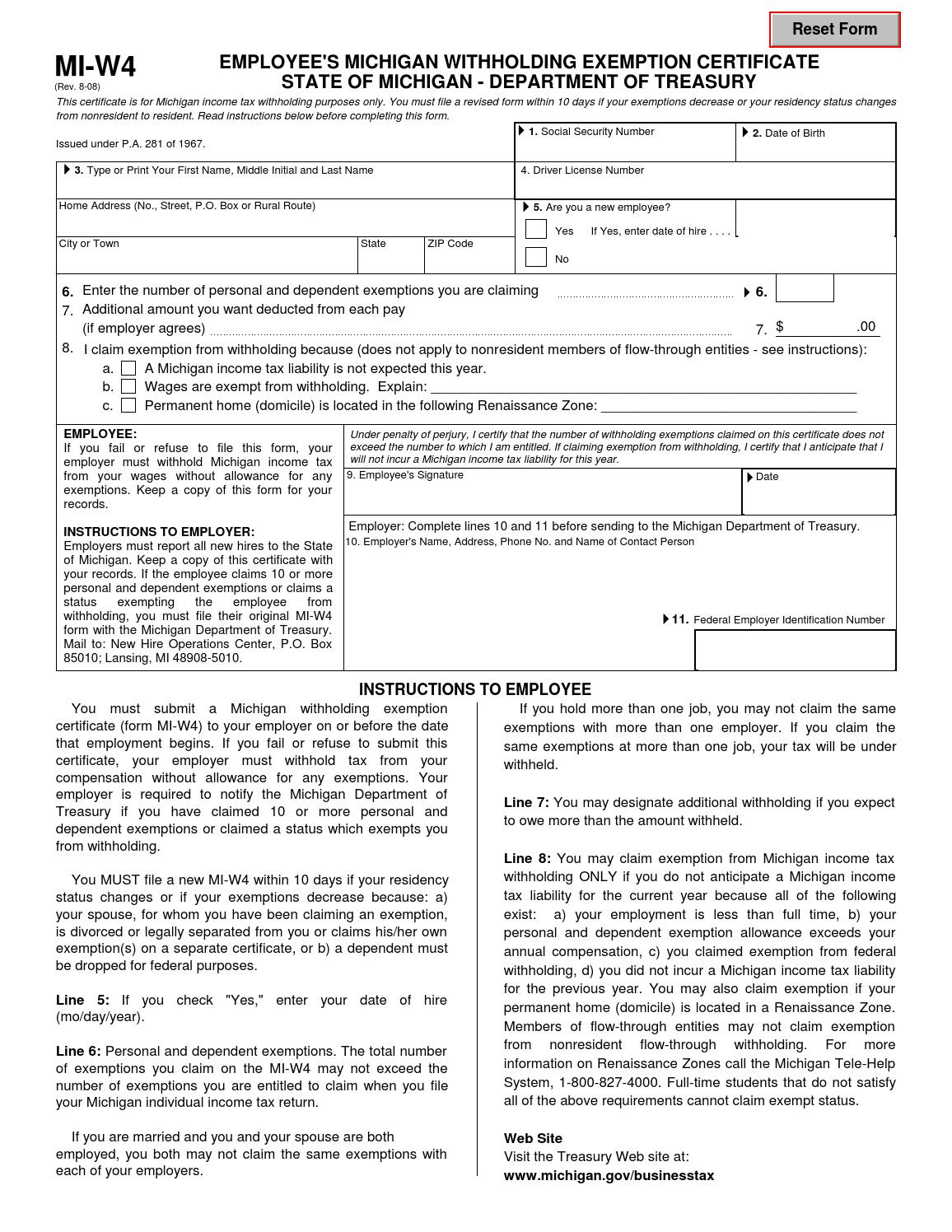

Michigan Estimated Tax Payments 2025 Forms Leann Zsazsa, Calculate your state income tax step by step.

Edd Employee Withholding Form Withholdingform Com vrogue.co, The basic steps for calculating utah withholding tax are as follows:

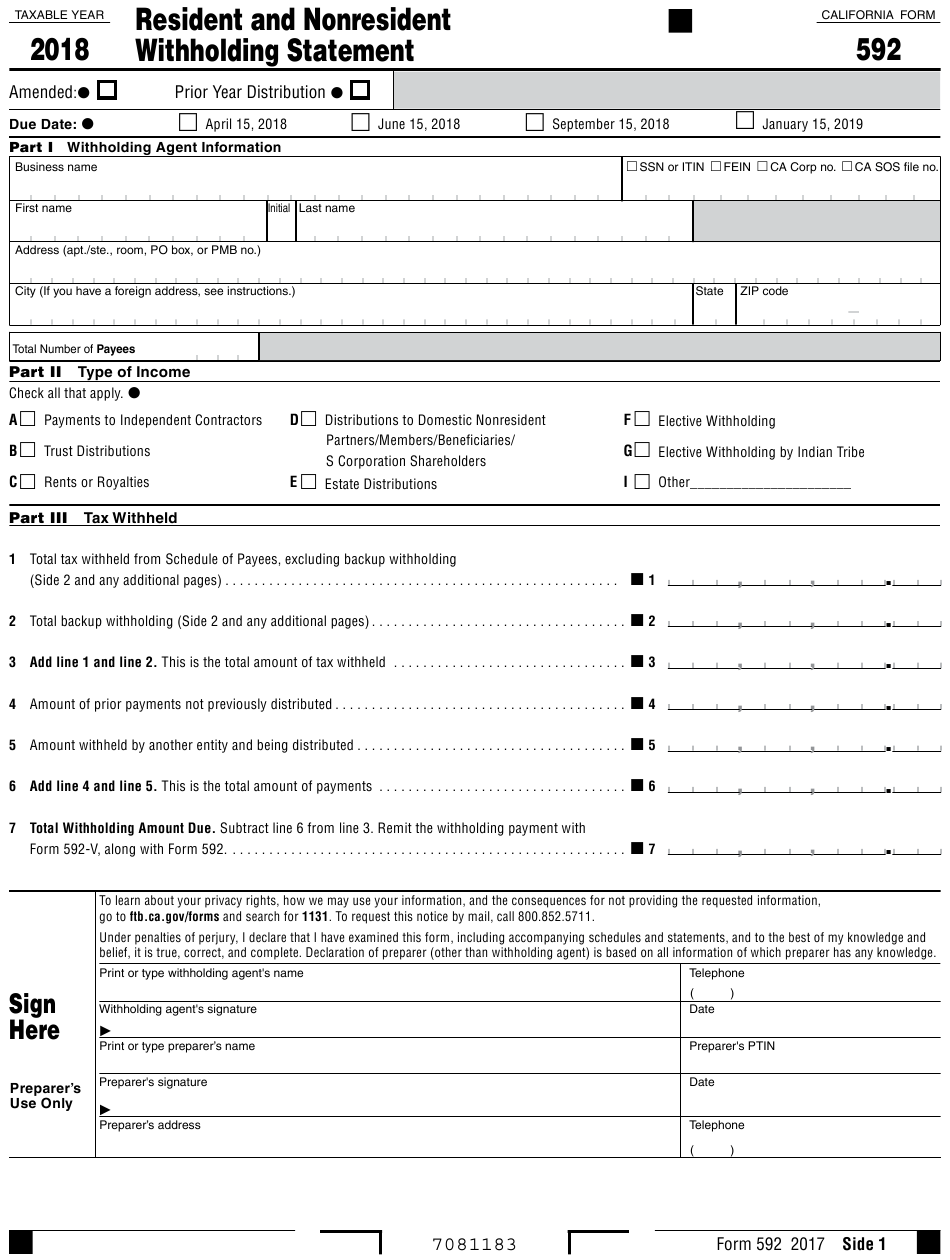

California State Withholding Form 2025, Check the 2025 utah state tax rate and the rules to calculate state income tax.

Nm State Tax Withholding 2025 abbye, Utah residents state income tax tables for single filers in 2025 personal income tax rates and thresholds (annual) tax rate.

2025 Irs Form W 4v Printable Forms Free Online, You are able to use our utah state tax calculator to calculate your total tax costs in the tax year 2025/25.

Edd Employee Withholding Form Withholdingform Com vrogue.co, If you want to simplify payroll tax calculations, you can.

Edd Employee Withholding Form Withholdingform Com vrogue.co, The basic steps for calculating utah withholding tax are as follows:

Utah State Withholding Form 2025 Lexis Opaline vrogue.co, Silver lake, big cottonwood canyon, by colton matheson utah.gov home

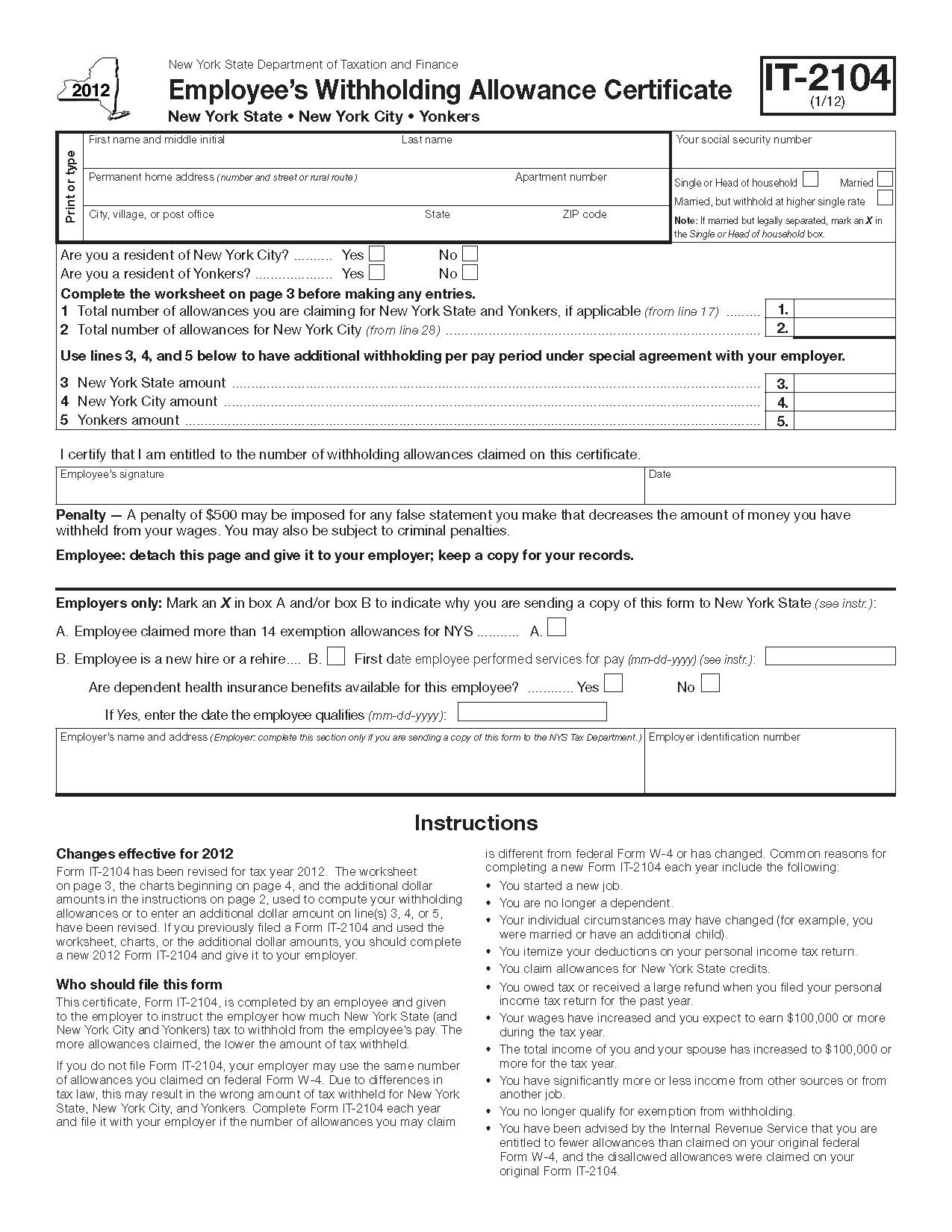

What Is Employee S Illinois Withholding Allowance Certificate, Below are direct links to common forms and a link that you.