Gsa Mileage Rate 2025 Per Mile Nj. Rate per mile january 1, 2025 $0.655 july 1, 2025 $0.625 january 1, 2025 $0.585 january 1, 2025 $0.56 january 1, 2025 $0.575 january 1, 2019 $0.58 january 1, 2018 $0.545. A mileage allowance for using a privately owned vehicle (pov) for local, temporary duty (tdy), and permanent change of station (pcs) travel is.

Standard mileage rates for 2025; Under current law, the state’s mileage reimbursement rate is $0.18 cents per mile, adjusted biannually to reflect changes in gasoline prices.

1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

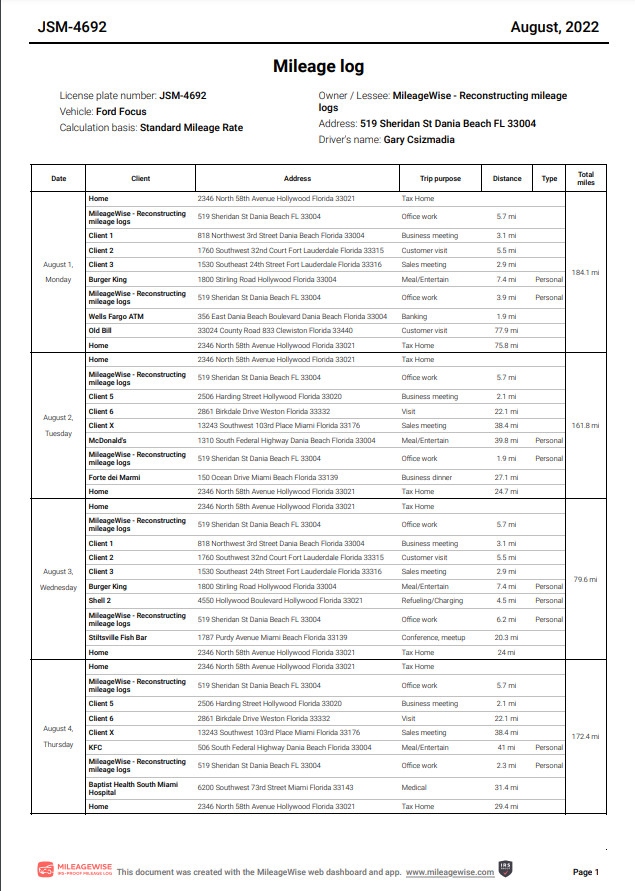

Free Mileage Log Templates Smartsheet (2025), A mileage allowance for using a privately owned vehicle (pov) for local, temporary duty (tdy), and permanent change of station (pcs) travel is. In accordance with state and und travel policy, the personal vehicle mileage rate for 2025 has been updated to the current gsa level:

GSA Raises Mileage Rates For Traveling Feds, At the end of last year, the internal revenue service published the new mileage rates for 2025. Understanding mileage reimbursements and rates.

Rate Per Mile Calculator, On december 17, 2025, the irs announced that beginning on january 1, 2025, the standard mileage rates for the use of an automobile would be 58.5 cents per. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025.

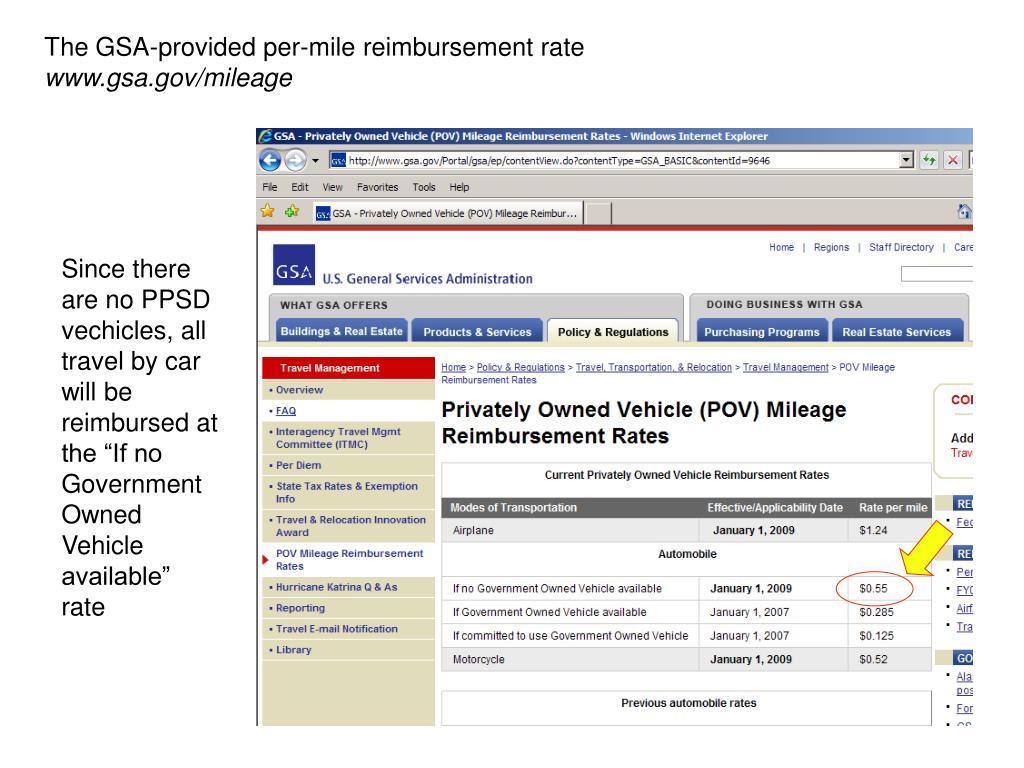

PPT The GSAprovided permile reimbursement rate gsa/mileage, Airplane nautical miles (nms) must be converted to statute miles (sms). 67 cents per mile driven for business use,.

Mileage Log Samples Standard Mileage Rate and Actual Expense Method, 67 cents per mile driven for business use,. A mileage allowance for using a privately owned vehicle (pov) for local, temporary duty (tdy), and permanent change of station (pcs) travel is.

How to Calculate Cost per Mile for Trucking, 67 cents per mile driven for business use,. The current irs mileage rates (2025) april 7, 2025.

Auto Müssen Sie bald eine Kilometersteuer zahlen? SamaGame, The standard conus lodging rate will increase from $98 to $107. Historical mileage rates year by year from 2018 to 2025.

2025 Mileage Rate Gsa Latest News Update, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025. Standard mileage rates for 2025;

Irs Allowable Mileage Rate 2025, In accordance with state and und travel policy, the personal vehicle mileage rate for 2025 has been updated to the current gsa level: For 2025, the business standard mileage rate is 67 cents per mile driven.

Mileage Rate 2025 Top 5 Insane Tax Hacks You Need!, The general services agency (gsa) has released new rates for reimbursement of privately owned vehicle (pov) mileage for 2025. At the end of last year, the internal revenue service published the new mileage rates for 2025.

The general services agency (gsa) has released new rates for reimbursement of privately owned vehicle (pov) mileage for 2025.