2025 Fed Tax Tables. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. For married couples who file a joint tax return, the 2025 income brackets and corresponding tax rates are as follows:

Looking ahead, jd sports expects its profit before tax for the upcoming year to be in the range of £900 million to £980 million, 10% below consensus estimates. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Tax rates for the 2025 year of assessment Just One Lap, 2025 and 2025 tax brackets and federal income tax rates. The oecd on average raised 5.4 percent of total tax revenue from property taxes, compared to 10.4 percent in the united states.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, This page provides detail of the federal tax tables for 2025, has links to historic federal tax tables which are used within the 2025 federal tax calculator and has supporting. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

Maximize Your Paycheck Understanding FICA Tax in 2025, 10%, 12%, 22%, 24%, 32%, 35% and 37%. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

20242024 Tax Calculator Teena Genvieve, The most aggressive prediction now, in the march projections, has been dialed back to just four cuts. 2025 and 2025 tax brackets and federal income tax rates.

50 Shocking Facts Unveiling Federal Tax Rates in 2025, Understanding how your income falls into different tax brackets can help with tax. Taxable income and filing status determine which federal tax rates apply to you.

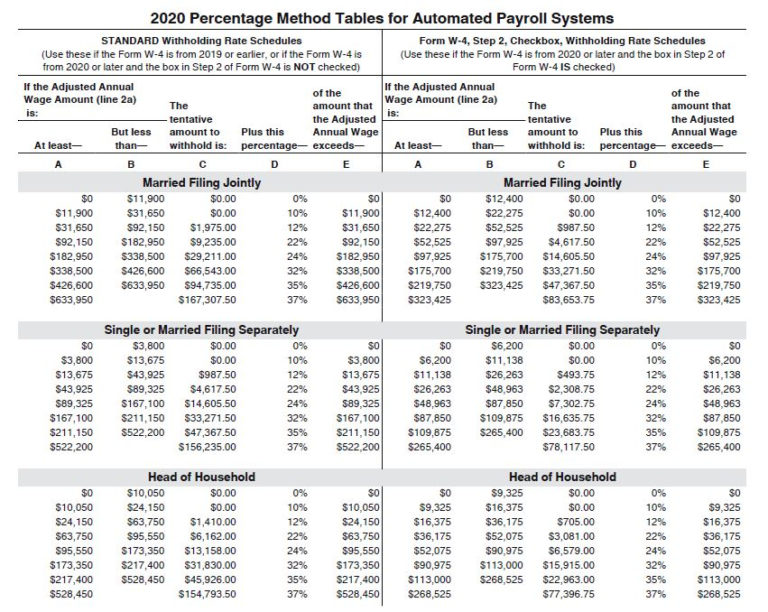

How To Calculate Federal Tax Withholding Tables Federal Withholding, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37. Income phaseouts begin at magi of:

T130241 Distribution of Federal Payroll and Taxes by Expanded, Up to $23,200 (was $22,000 for 2025) — 10%;. The most aggressive prediction now, in the march projections, has been dialed back to just four cuts.

20222023 Tax Rates & Federal Tax Brackets Top Dollar, Personal exemptions, standard deductions, limitation on itemized deductions, personal exemption phaseout thresholds, and statutory marginal. The oecd on average raised 5.4 percent of total tax revenue from property taxes, compared to 10.4 percent in the united states.

20232024 Tax Brackets and Federal Tax Rates NerdWallet, There are seven tax brackets for most ordinary income for the 2025 tax year: In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Publication 17, Your Federal Tax; Tax Tables Taxable, Bloomberg tax has released its annual projected u.s. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).